To balance out the conservative asset allocation model and money market replacement, one can try to be a little more aggressive and add in other components such as technology and inflation hedging such as gold and non-correlated asset such as bitcoin. With Fed money printing go into hyperdrive, we will likely see not only today’s asset bubble, but also inflation down the road.

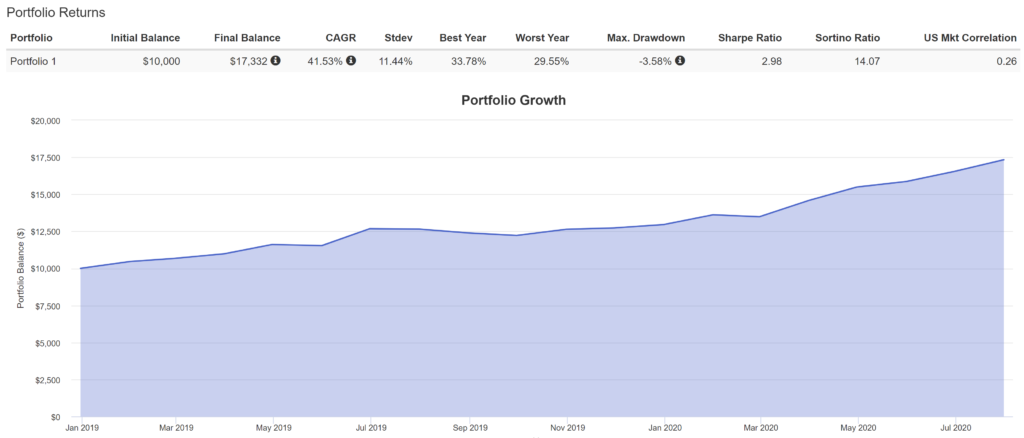

As a brain teaser, here is a sample of 4 non-correlated assets together to generate a relatively high return, medium volatility, hedged portfolio:

- Invesco QQQ Trust (QQQ): 75%

- S&P 500 VIX (VIX): 10%

- SPDR Gold Shares (GLD): 10%

- Grayscale Bitcoin Trust (GBTC): 5%

With this portfolio, you will get YTD return of 34%, Max drawdown of -3.5%, Sharpe Ratio around 3 and Sortino Ratio of 14, not bad for an aggressive portfolio

It would be good to get some feedback on other potential asset allocation model.