Given this week’s market volatility, let’s revisit some of the famous all weather portfolios. Ray Dalio is one of the greatest fund managers of our time. He started without any money and build up a financial empire from scratch. His views on the latest economic development and big debt cycle are very insightful.

He did one of the interviews with Tony Robins on the all weather portfolio. The baseline concepts are very simple: 1) one needs to prepare for inflationary environment and deflationary environment 2) Volatility in stock is much more than bond, as such, one should allocate more in bond to balance out the stock volatility.

So the model portfolio is the following:

- US Equity: 30%

- US Long Term Bond: 40%

- US Short Term Bond: 15%

- Inflation hedging such as Gold: 7.5%

- Inflation hedging such as Commodity: 7.5%

Here are the ETFs fund choices we picked for testing:

- US Equity: Vanguard Total Stock Market ETF (VTI)

- US Long Term Bond: iShares 20+ Year Treasury Bond ETF (TLT)

- US Short Term Bond: iShares 1-3 Year Treasury Bond ETF (SHY)

- Gold: SPDR Gold Shares (GLD)

- Commodity: Invesco DB Agriculture (DBA)

Here are the no-load no-fee mutual funds we picked for testing.

- US Equity: Vanguard Total Stock Mkt Idx (VTSAX)

- US Long Term Bond: Vanguard Long-Term Bond Index Instl (VBLLX)

- US Short Term Bond: Vanguard Short-Term Bond Idx (VBIPX)

- Gold: The Gold Bullion Strategy Fund Investor Class (QGLDX)

- Commodity: AQR Risk-Balanced Commodities Strategy Fund Class N (ARCNX)

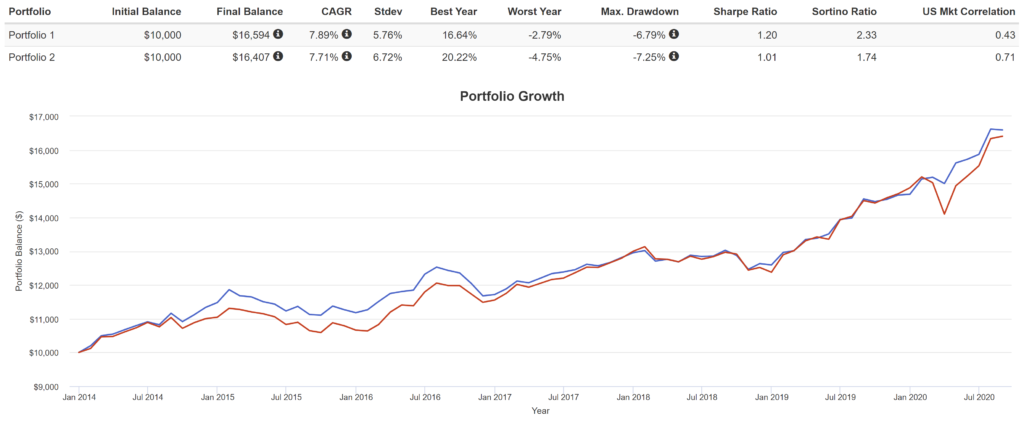

Your results will be a little different depend on ETF and mutual fund representations. Regardless of the funds you pick, we still see quite a lot of volatility in this portfolio model. Below is the historic test run. Portfolio 1 uses ETF and portfolio 2 uses mutual funds.