We started to accumulate gold and silver in March 2020 when these assets drops significantly with the market. When we started to build out our position, we planned to use these assets mainly as a hedge against uncertainty and dollar devaluation. It wasn’t until federal reserve started to pump trillions of dollars into the market with new QE that we start to feel scared and shifted some allocation to 2x ETFs to increase our leverage.

For example, here is a comparison of Gold ETF (GLD) vs Gold Miner ETF (GDX). Portfolio 1 is Gold ETF (GLD) and portfolio 2 is Gold Miner ETF (GDX).

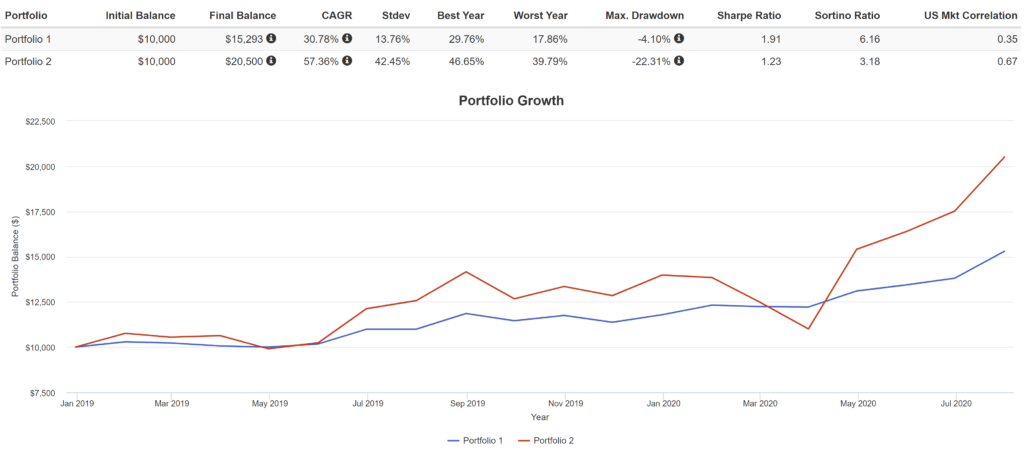

To go further, you can leverage up with 2x ETFs such as ProShares Ultra Gold (UGL). Below is a comparison chart of Gold (portfolio 1) and Ultra Gold (portfolio 2)

If you want to mainly buy mutual funds, here are a few fund choices that are free either on Fidelity and Charles Schwab.

Gold Coin- Gold Bullion Strategy Investor (QGLDX) – Gold asset

- USAA Precious Metals and Minerals Fund Class A (UPMMX)

- American Century Global Gold Fund Investor Class (BGEIX)

- Invesco Oppenheimer Gold & Special Minerals Fund Class A (OPGSX)

- Gabelli Gold AAA (GoldX)