We talked about how to use Sortino Ratio as a way to judge risk/reward ratio in our last blog post. Given the fast rising valuation in the last few months, Covid-19 headwind and continuous deterioration of US/China relationship, we think it is prudent to think about not only various asset allocation models which we shared in previous blogs, but also ETFs and mutual funds we can use to provide a potential hedge against the downturn.

Market tends to swing between greed and fear. So when market is in the fear mode, CBOE Volatility Index (VIX) index tends to go up while the market comes down. It is not a reverse index, it is more of a fear index that one can use to balance one’s portfolio. Even though there is not a direct way to buy into VIX itself, there are several ETFs/ETNs one can use. But keep in mind that VIX is highly volatile, and tend to lose value over time. It is best not to treat it as a long term holding, more of a short term tool to help hedge market volatility. It is hard to find a VIX mutual fund, maybe due to its short term hedging nature and representation.

The easiest way to trade is probably using a product like VXX , an exchange-traded note (ETN). It has over $700M in net asset and is pretty liquid. Another product is ProShares Ultra VIX Short-Term Futures ETF (UVXY) which provides 1.5x leverage and produces more hedging with same amount of deployed capital.

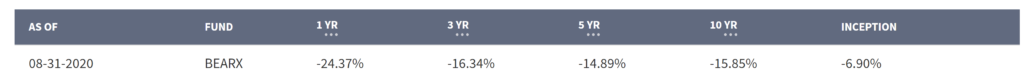

If you are a mutual fund investor, the best hedging might be diversification since it is one of the best long term winning formulas. Keep in mind that in this environment, one should not only diversify over bond and stock, but also diversify with international and emerging market assets, along with currency and precious medal assets such as gold and silver. In certain times, one can also add bear market fund such as Prudent Bear Fund (BEARX). Prudent bear fund has been there for a long time. Given how well the market had performed, it is hard to hold a bear market fund. Here is its fund performance from its web site. Its IRR in the last 10 years is -15%. Again, just like VIX, we recommend using it as a short term hedging strategy vs a long term position.