Bitcoin and cryptocurrencies as a group are making a run in the last few days, especially Bitcoin. It is not surprising since a lot of traditional gold investors are piling into crypto investments, along with the new entry of financial institutions such as Coinbase, Paypal, Robinhood that enable retail investors to participate. In addition, since there is no return in cash, some of the companies such as MicroStrategy are adding bitcoin to their corporate treasury. So a new wave of bitcoin investment begins… As a disclaimer, I use bitcoin interchangeably with cryptocurrency since it is easier to think of one asset vs a group, but the trend analysis is the same.

Typically you will see multiple types of supporter ecosystems around crypto space. I will list 3 common ones below:

- An asset that can maintain its value. Similar to gold, bitcoin pay no interest nor dividend. Because of its limited quantity restricted by mathematics, investors in this camp mainly view bitcoin as a mean for asset protection, and to maintain a stable purchase value for inflation hedging.

- Transaction medium. Investors in this camp tend to see bitcoin as a potential transaction medium that someday can replace paper dollar. This is a similar concept to Facebook Libra Coin and Chinese Digital Yuan. But it is not centralized managed, but P2P based on blockchain.

- New technology ecosystem infrastructure that enable large number of new applications from banking and finance to daily security and privacy. This is less driven by Bitcoin, but more around programmable crypto coins such as Ethereum and EOS, or Compound in DeFi.

Personally, I think #1 and #3 make more sense. While #2 could be useful, it is unlikely to be successful given the sovereign nation currency requirements and technology architecture around transaction rate etc.

So how do investors invest in bitcoin and cryptocurrency?

If you are a regular financial investor, the easiest way is to open a Coinbase account and start buying the crypto assets. Click here to Coinbase.

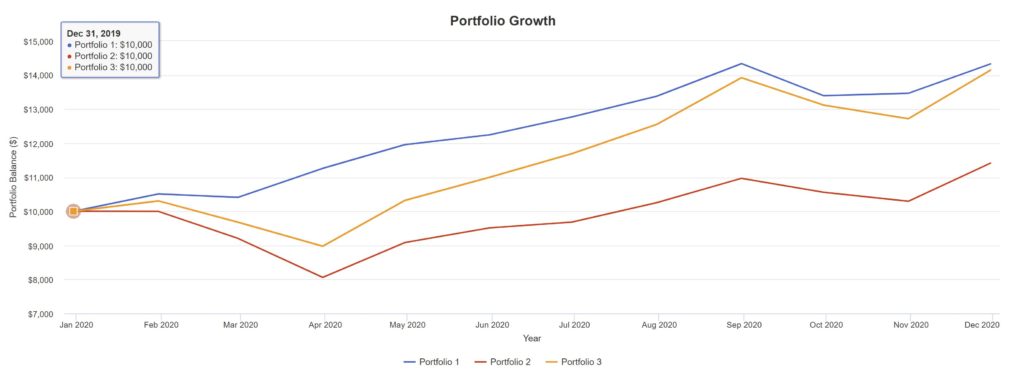

If you don’t want to go through the hassle of buying crypto itself, there is a Bitcoin ETF called Grayscale Bitcoin Trust (GBTC). At the end of August, we illustrated adding bitcoin investment for a technology hedged portfolio that consists only 4 assets: Invesco QQQ Trust (QQQ), S&P 500 VIX (VIX), SPDR Gold Shares (GLD), Grayscale Bitcoin Trust (GBTC) (See Blog Here). If you tried that portfolio, your portfolio will do pretty well. Below is the performance data compare our technology hedged portfolio to 100% SP500 (SPY) portfolio and 100% Nasdaq (QQQ) portfolio in 2020. In the graph, our portfolio value is in blue, SPY in red and QQQ in orange.

| Return | Stdev | Best Year | Max. Drawdown | Sharpe Ratio | Sortino Ratio | |

| FundMojo | 43.29% | 14.99% | 43.29% | -6.57% | 2.7 | 5.8 |

| SPY | 14.14% | 26.90% | 14.14% | -19.43% | 0.64 | 1.07 |

| QQQ | 41.47% | 27.18% | 41.47% | -12.90% | 1.51 | 3.39 |

If you are looking for more investment opportunities beyond public listed assets, you can also check out crypto and blockchain startups on ventures media. It provides a very comprehensive listing of the cryto and blockchain companies.

Since cryptocurrency is highly volatile, please make sure you don’t put all eggs into one bucket and can tolerate a 50% crush that comes once a while.