We have been playing with various portfolio constructions for this hyper volatile market. Fed’s decision to cut interest rate to zero is pushing conservative people from money market funds into higher risk investments. While the market keeps on hitting new highs, there are quite a lot of hidden dangers in the market place. There are a few models we have been looking at and here is one example model that seem to do well in the last few years.

This asset allocation portfolio is very simple with 3 mutual funds that are no load in Fidelity and Schwab:

- BlackRock Systematic Multi-Strat Inv A (BAMBX)

- American Funds Strategic Bond F-1 (ANBEX)

- Eaton Vance Short Duration Gov Inc A (EALDX)

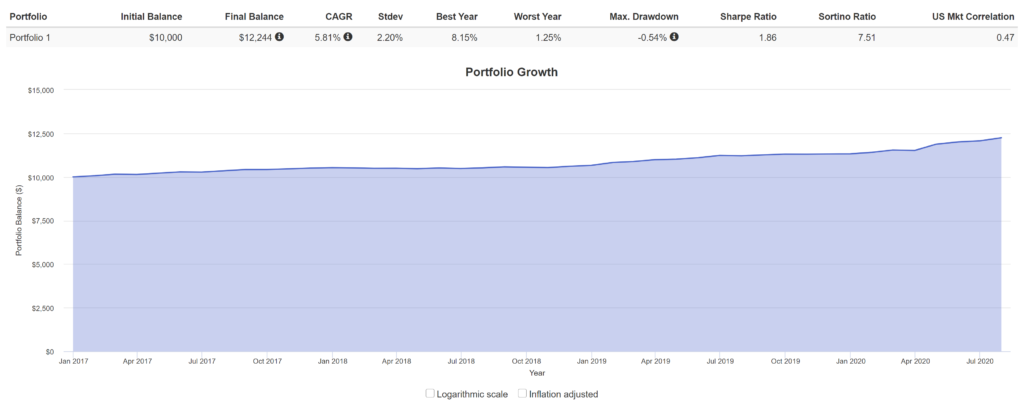

This asset allocation portfolio has returned 8.15% YTD, max drawdown of -0.54% since January 2017 including the sharp downturn of 2020, 1.86 Sharpe Ratio and 7.5 Sortino Ratio. You can play with different mix, but this is a very simple construction, probably presents a good option vs just a simple bond fund on a risk/reward side.

Hopefully it helps. If you have a better conservative model that works, please kindly share. Thanks.